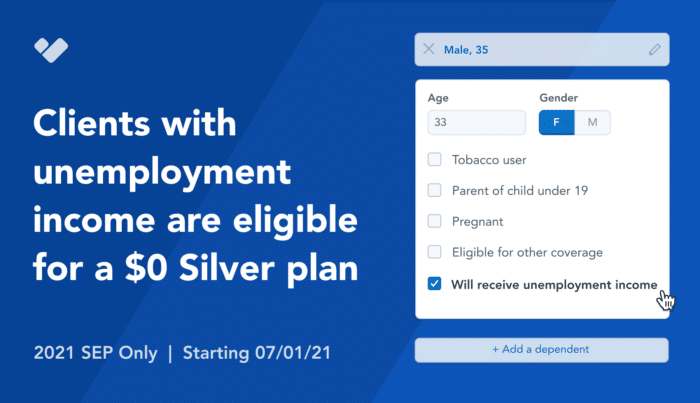

Starting 7/1/21: Clients are eligible for a $0 silver plan with unemployment income

Starting July 1st, 2021, individuals with at least 1 week of unemployment compensation (UC) in 2021 can enroll in a free Silver plan with an earliest effective date of August 1st.

This measure was part of the American Rescue Plan Act (ARP), and you will be able to service any eligible clients through HealthSherpa. In this guide, we’ll cover changes you will see within the agent account, resources for client outreach, and an overview of what you need to know about this measure.

How the unemployment income measure will be incorporated into the HealthSherpa for Agents account

Clients who qualify for unemployment compensation won’t automatically receive these benefits, regardless of whether they attested to receiving UC on their application. They will have to come back and re-submit in order to get a new eligibility notice that lists their updated APTC/CSR.

If clients do not re-submit their applications, they will receive any APTC they should have qualified for back when they file their 2021 federal income taxes. However, CSR benefits are not payable retroactively. Therefore, it’s especially important for households receiving UC to re-submit their applications as soon as possible to ensure they are receiving the maximum benefit they are eligible for.

HealthSherpa plans to release the following changes within the quoter, shopping and application experiences to help agents service their existing and new clients:

How to get additional unemployment subsidies for existing clients

Within a client’s profile, click on the green ‘Apply new subsidy’ button to step through the application, update unemployment information as needed, and re-submit the application with the new subsidy applied.

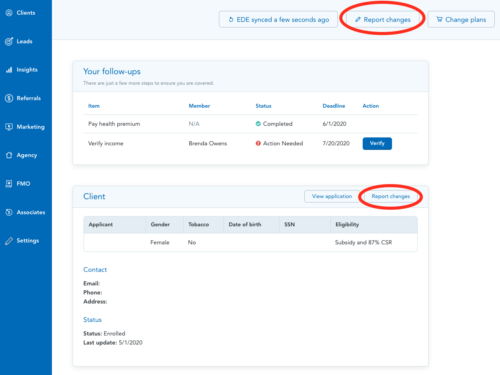

You can also click on `Report changes` in two places within the client’s profile: either from the client card shown below, or on the top right of the client’s profile if EDE enabled. Follow the prompts to report unemployment income and re-submit the application for the new subsidy.

How to get additional unemployment subsidies for new clients

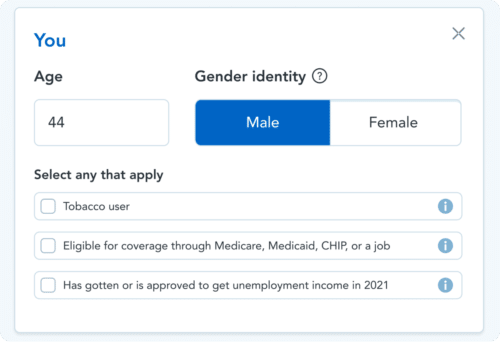

To see and compare quotes that reflect the new subsidy. Select the checkbox ‘has gotten or is approved to get unemployment income in 2021’.

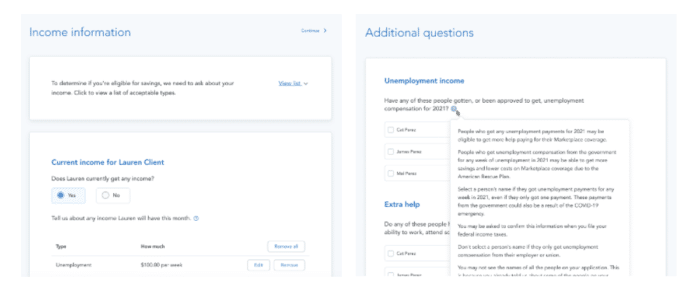

Include unemployment income in the application. Make sure to include information for all tax filers (including dependents) in the ‘Income information’ and ‘Additional questions’ sections.

Resources for client outreach

Our team also put together some resources to help you identify eligible clients in your book and to assist with outreach:

Identify eligible clients using the Export Report

When you initially enrolled your clients in Marketplace coverage, you had the option to attest that your client would receive unemployment income in 2021.

For any applications where you checked that box, has_unemployment_income will populate with ‘Yes’. You will be able to filter your Export Report on this column to identify a list of clients to reach out to about their coverage options.

Click here for steps on downloading your export report.

Templates for outreach

You may have clients who qualify for these free Silver plans that didn’t attest to receiving unemployment income in their original application. To jumpstart your outreach, we’ve put together email templates that you can use today.

Important details about the American Rescue Plan’s changes to unemployment income

This section will explain who can benefit from this new rule around UC as well as important details about eligibility and what clients should consider before switching plans.

What are the new unemployment subsidies, and who is eligible?

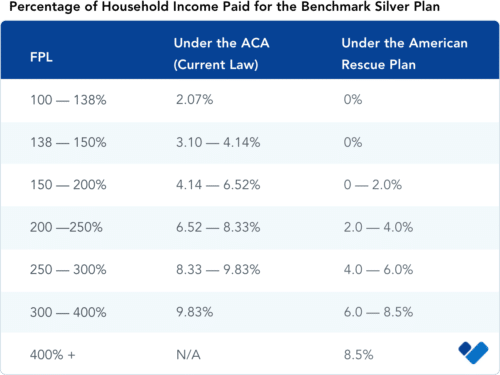

Any tax household with at least one member who has received at least one week of unemployment compensation in 2021 may be eligible for the new benefit; both regular unemployment compensation and federal pandemic unemployment compensation qualify. Tax households who meet these criteria will be assessed for CSR, and usually also APTCs, as if their income was 133% of the FPL.

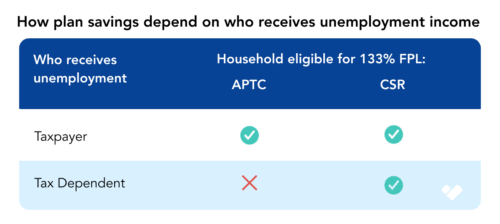

The benefit is calculated differently depending on which members of the household have received UC. If the member(s) receiving UC are all taxpayers, the household will be assessed as if their income was 133% of FPL for the purposes of both APTC and CSR. This means the benchmark silver plan and all cheaper plans will have a $0 premium.

However, if the only member of the household receiving UC is a dependent, then the household will be treated as 133% of FPL for the purposes of determining eligibility for CSRs only; the APTC will be calculated based on their actual income.

The Marketplace defines a dependent as a child or other individual for whom a parent, relative, or other person may claim a personal exemption tax deduction. Note that children claimed as dependents still qualify as dependents under this rule, regardless of whether they have income and are required to file.

It’s important to note that this new benefit doesn’t change the basic rules about who qualifies for APTC or CSRs – household members with an affordable offer of employer coverage are not eligible to take these subsidies.

Do households who fall into the Medicaid Gap qualify for this benefit?

Yes, this benefit can be claimed by eligible households receiving UC, regardless of their actual income. This means that households who make <100% of FPL in states that did not expand their Medicaid programs can qualify if they are otherwise eligible (e.g. do not have an offer of employer coverage.)

How long will the UC benefits last?

These extra benefits for individuals receiving UC are only valid for the 2021 plan year. The broader ARP subsidy expansions, which we covered in this article, will remain in effect for the 2022 plan year.

My clients who qualify for this benefit are also offered free COBRA; which should they choose?

Many clients who qualify for this benefit may also be offered free COBRA until 9/30. Whether they should elect a Marketplace plan with the expanded UC benefits or free COBRA will depend on their individual circumstances. Here are some factors to consider:

(i) Has the client met their deductible? If not, switching to a Marketplace plan may be the financially wiser move, even though progress towards their deductible and out of pocket maximum (OOPM) will reset. At 133% FPL, deductibles range from $0 to a few hundred dollars – much lower than the average for COBRA, which is $1,644 for single coverage. Likewise, OOPMs at 133% are set at $2,850 for single coverage, much lower than the average employer OOPM of $4,039.

(ii) Does your client need access to specific doctors? Generally, networks for employer coverage are richer than for Marketplace plans, and the Marketplace generally has fewer PPO options. If your client needs to keep a specific doctor, make sure to carefully assess whether they can continue doing so under a new Marketplace plan, or whether sticking with COBRA is a better bet.

Connect and prepare with your clients today

Get ahead using our email templates for outreach to your clients about this new rule around UC. The HealthSherpa Export Report can help you personalize your outreach to clients who may have told you during their initial application that they were receiving unemployment compensation.

New to HealthSherpa? Don’t worry — it’s easy to get started with a free HealthSherpa for Agents account. HealthSherpa is an approved direct enrollment pathway for healthcare.gov, and we are able to help you enroll your clients directly on our site with Enhanced Direct Enrollment (EDE). Through a HealthSherpa account, you can enroll, track, and service your ACA clients year-round. Visit our HealthSherpa for Agents page today to learn more and sign up for an account.